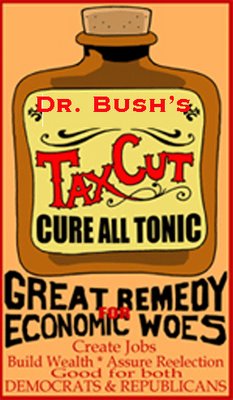

NO JUSTIFICATION FOR BUSH'S TAX CUTS BEING MADE PERMANENT

United for a Fair Economy (UFE) recently issued a report, "Nothing to be Thankful For: Tax Cuts and the Deteriorating U.S. Job Market," in which they examined periods after significant tax cuts and tax increases to discover if there is, as the Bush administration claims, a correlation between large tax cuts and job growth. With GM, Ford and other companies announcing massive layoffs, it's a fair question.

The Bush administration’s promise that tax cuts for the rich would trickle down to workers has been broken. And when tax cuts and more tax cuts haven’t succeeded in job creation or economic stimulus, how can we expect that still more tax cuts or permanent tax cuts somehow will? As another year of jobless recovery draws to a close, this report exposes the false claim that tax cuts have the power to create much-needed new jobs in our economy, and asks the question: “Have tax cuts given most of us anything to be thankful for?”

Among the findings:

1. The Bush tax cuts did not produce new jobs.

2. Changes in tax policy have no clear impact on job growth.

3. The quality of jobs as measured by income, health insurance and retirement benefi ts has declined appreciably since the 2001 tax cuts.

4. African-American and Latino families have seen their economic security deteriorate at an even greater rate than white families.

5. Tax cuts for today’s taxpayers are a tax burden for tomorrow’s taxpayers.

Since 2001 when the tax cutting party began, declining family incomes, reduced access to health care and anxiety about retirement security have occurred on a widespread scale — not the shared prosperity, high employment and better life that were promised in the invitation to the feast. Only the richest receive these benefi ts, along with the increasingly low tax rates that are the hallmark of the plan. We see the broken promises of White House forecasts to deliver millions of added jobs. Worse still, we see a widening of the gap between rich taxpayers and everyone else, and an exacerbation of the wealth divide among the races, with unemployment among blacks and Latinos diverging from white unemployment by ever-widening margins.

The perceived public appetite for tax cuts is not born of a desire to deprive government of funding adequate to carry out its mission, as many administration offi cials would maintain, but rather a desire by insecure citizens to have a more economically secure life. In poll after poll, when voters are surveyed about their desire for tax cuts as opposed to improving valued government services like education and health care, signifi cant majorities choose the government services they most value.

The tax cutting policy is bankrupt — it has no effect on GDP, and its windfalls are just as likely to fund the purchase of jewels or artwork for private collections as to fi nance new factories that create new jobs. It’s time to recognize that jobs are both created and destroyed during times of tax decreases. The same is true during periods of tax increases. If what we value as a nation is opportunity and economic security for all, if we believe that everyone should have a job and that work should pay, if we believe our nation has enough so that every hungry child can be fed, then it is these measures that should be evaluated in light of calls to reduce tax cuts.

What have tax cuts given us to be thankful for? Nothing. The 2001 and 2003 tax cuts were a feast for the rich taken directly from the tables of the poor, the working class, the middle class, people of color, children and the elderly. Tax cuts were made in the name of jobs that have not materialized. Instead, they reveal a government acting in service of the voracious appetite of a tiny minority, the very richest few, in the United States.

The entire report can be found here.

Moreover, the Center on Budget and Policy Priorities reported a year ago that the majority of the benefits that small businesses receive from the tax cuts enacted since 2001 go to an elite group of owners with considerable wealth and high incomes (their report can be found here).

Now the House was forced to back off making the cuts permanent, but the Rethugs will call for a vote again soon. In the face of the mountainous debt Republicans have enabled this moron we call a president to roll up, with the astronomical costs associated with the wars in Iraq and Afghanistan, and with vital domestic programs needing to be funded such as implementing the recommendations of the 9/11 Commission, disaster relief in the wake of the rash of killer hurricanes experienced this year, healthcare and education priorities, there is no possible justification that can be made for making the tax cuts permanent. The only argument the Rethugs have tried successfully, that of the promise of jobs growth, has just been refuted.

Tags: Bush tax cuts, jobs growth

0 Comments:

Post a Comment

<< Home